Car Financing Options in Ireland (2025)

Considering car finance in Ireland? Learn all about PCP, Hire Purchase, Leasing, and Bank Loans. Understand the pros and cons, find the best value, and choose the right finance for you.

Financing a car is often the second-biggest financial commitment people make, so choosing the right funding method is crucial. The way you finance a vehicle can dramatically affect its long-term cost – from the interest you pay to any fees or restrictions you face. For anyone wondering how to finance a car in Ireland, it’s important to understand all the options and their implications before signing on the dotted line. Different plans can affect your monthly payments, ownership of the car, and even how you’re allowed to use the vehicle. In short, car finance isn’t just about getting the keys – it’s about understanding a multi-year financial commitment and ensuring it aligns with your budget and plans. Whether you’re a private buyer or a business owner, doing your homework now can save a lot of money and hassle down the road.

Before you start browsing car listings on resources like CarSpot for that perfect vehicle, take some time to learn about Ireland’s main car financing options available in 2025. In this guide, we’ll break down the pros and cons of each method – from flexible plans like PCP to traditional bank loans – and provide real-life examples to illustrate which option might be the best car finance in Ireland for your needs. By the end, you’ll be equipped to compare PCP vs HP Ireland deals, evaluate leasing and loan offers, and make an informed decision on financing your next car.

Types of Car Financing in Ireland

Ireland’s car buyers and businesses typically use a few key financing methods. The main types of car finance in Ireland are Personal Contract Purchase (PCP), Hire Purchase (HP), Leasing (for personal or business use), and traditional car loans (from a bank or credit union). You may also encounter dealer-arranged finance versus loans from independent lenders. Each option works differently and has unique advantages and drawbacks. Below, we delve into how each financing type works, what to consider, and who it’s best suited for.

Personal Contract Purchase (PCP)

PCP (Personal Contract Purchase) is a popular car finance option, especially for new cars. How it works: You pay a deposit upfront (often around 10%–30% of the car’s price) and then make relatively low monthly payments for a set term, usually 3 years. Those monthly payments don’t cover the car’s full value – they primarily cover the depreciation of the vehicle during the term. At the end, there’s a large final payment (often called a balloon payment, representing the car’s Guaranteed Future Value or GFV) if you want to take ownership. Essentially, you’re financing part of the car’s cost now and deferring a big chunk to the end.

After the term, you typically have three options:

- Buy the car: Pay the final balloon amount (GFV) and you become the owner.

- Return the car: Hand the car back to the finance company/dealer. If the car is within the agreed mileage and in good condition, you owe nothing further.

- Trade in for a new car: Return the car and, if it’s worth more than the GFV, use the equity as a deposit toward a new car (starting a new PCP). If it’s worth less, you could owe the difference or simply walk away by returning the car.

During a PCP, you hire the car – you don’t own it until you make the final payment. There are also usage conditions: you must stick to a mileage limit agreed at the start, and keep the car in good condition (normal wear is fine, but damage can incur fees). Servicing may need to be done at approved garages as well. These terms ensure the car will be worth at least the GFV at term’s end.

Pros: PCP’s popularity is due to several benefits:

- Lower Monthly Payments: Because you’re financing only part of the car’s value (the rest is deferred), monthly payments are usually much lower than with an HP or loan. This often lets you afford a more expensive or newer model than you otherwise could.

- Flexibility at the End: You have options to upgrade, keep, or return the car at the end of the agreement. This flexibility is great if you like to change cars every few years – PCP makes it easy to switch to a new model without the hassle of selling your old car.

- Low Deposit: Many PCP deals have modest deposit requirements (around 10%, sometimes more). Some promotions even offer zero deposit or allow a trade-in as the deposit, lowering the upfront cost.

- Access to New Cars & Extras: PCP is commonly used for new cars, and dealers often include perks. For example, manufacturers may offer discounted interest rates or free servicing packages to PCP customers. It can be a convenient way to always drive a nearly new car with the latest features.

Cons: It’s important to go in with eyes open, as PCP has some significant downsides:

- Mileage and Condition Restrictions: PCP agreements set an annual mileage cap and require you to keep the car in good condition. If you exceed the mileage or the car has more than fair wear and tear, fees will apply at return. This makes PCP less ideal if you have a long commute or tend to rack up a lot of kilometers.

- Large Final Payment: To keep the car, you must pay the balloon payment (the GFV) at the end, which can be thousands of euros. Many buyers cannot easily pay this lump sum and may need to refinance it or trade in the car. If you’re unprepared, you might find you’ve spent years paying for a car you can’t ultimately afford to keep.

- No Equity (Possibility of Negative Equity): Until that final payment is made, you’re not building equity in the car. In fact, if the car depreciates faster than expected or if you had a small deposit, you could end up in negative equity (owing more than the car is worth) at the end of the term. In such cases, there’s no trade-in value for a next car. Many Irish consumers have been surprised to find that after three years of payments and a deposit, they own little or no asset without the final payment.

- Complexity: PCP contracts can be complex financial products with a lot of terms and conditions. The concept of deferring payments and the conditions attached mean you really need to understand the fine print (e.g. fees for excess mileage, rules if you end the agreement early under the half-payment rule, etc.). It’s not as straightforward as a normal loan, and misunderstanding the terms can be costly.

Best for: PCP is best suited for buyers who value flexibility and lower monthly costs, especially those who plan to upgrade their car frequently. If you like having a new car every 2-4 years and don’t mind not owning the car at the end (unless you choose to pay), PCP can be attractive. It’s also popular for business users who want employees in newer vehicles (though businesses often consider leasing as well). However, if you drive high mileage or want to eventually own the car outright without a big payment, you might be better off with a different option. Always ensure you’re comfortable with the mileage limit and have a plan for the balloon payment if you intend to keep the vehicle.

Hire Purchase (HP)

Hire Purchase is one of the more traditional car finance arrangements, and while PCP has stolen some of its thunder in recent years, HP remains a solid choice – especially for those who ultimately want to own the car.

How it works: With an HP agreement, you typically pay a deposit (around 10%) and then fixed monthly installments over 1 to 5 years (sometimes up to 6 years) to cover the rest of the car’s price plus interest. Unlike PCP, there is no large balloon at the end – you’re paying off the entire value of the car over the term. Once you’ve made all payments (and a small option-to-purchase fee at the end, if applicable), the car becomes yours. During the agreement, you are effectively “hiring” the car from the finance company; the finance company is the legal owner until you make the last payment.

One aspect of HP under Irish law is the half rule (voluntary termination): if needed, you have the right to end the agreement early by returning the car, as long as you’ve paid at least 50% of the total HP price. This can provide an escape route in hardship, but you’d still be on the hook for half the loan and potential charges for excess wear if the car’s condition is poor. (In PCP, a similar rule exists since it’s a form of HP, but due to the balloon, you often haven’t paid half until very late in the term.)

Pros: HP offers several clear advantages:

- Eventual Ownership: You are working toward fully owning the car. Once the HP term is complete, the vehicle is yours with no further payments. There’s no uncertainty about a future balloon payment – if you stick to the plan, ownership is guaranteed.

- No Mileage Restrictions: Unlike PCP or leases, HP agreements do not impose mileage caps or strict return conditions. You’re free to drive as much as you need and customize or modify the car (within reason) because you intend to own it. This makes HP appealing to high-mileage drivers and those who want the car long-term.

- Straightforward Structure: HP is relatively easy to understand. You have a set interest rate, fixed term, and fixed payments, which makes budgeting simple. There are usually no surprise conditions – just make your payments and the car will be yours at the end. The predictability is a plus for many.

- Flexible Term Lengths: HP deals come in various term lengths (12 up to 60+ months), allowing you to choose a repayment period that suits your budget. A longer term lowers the monthly cost (at the expense of paying more interest overall), whereas a shorter term saves interest. You can tailor the plan more than with PCP, which is commonly a standard 36-month term.

- Often Available for Used Cars: While PCPs are commonly for new or nearly-new cars, HP is widely used for used car purchases as well. If you’re buying a used car from a dealer, HP might be the primary finance option offered. It can sometimes also carry lower interest rates on used cars compared to unsecured personal loans, since the car is collateral for the finance.

Cons: Some downsides to consider with Hire Purchase:

- Higher Monthly Payments: Because you’re financing the entire cost of the car (minus deposit) and not deferring any big chunk to the end, monthly payments on HP are higher than PCP payments for the same car. For budget-sensitive buyers, the difference can be significant – PCP might put a new car within reach whereas HP might not.

- Initial Deposit Often Required: HP typically requires a deposit (commonly ~10% or more) to start. This upfront cost could be a hurdle if you haven’t saved enough or don’t have a trade-in. Some dealers may offer zero-deposit HP deals, but that will raise the monthly payments further.

- You Don’t Own the Car Until the End: During the HP term, the car isn’t truly yours. If you fail to meet payments, the finance company can repossess the car (since it’s their asset until you pay it off). You’re also not free to sell the car without the lender’s permission because there’s a financial interest registered against it. In practice, this means less flexibility if your situation changes – you are committed to the car from the start, unless you invoke the half rule to terminate early (which still costs money).

- Depreciation Risk: Since you will own the car, you bear the full risk of its depreciation. If you decide to sell before you’ve finished paying, the car’s market value might be less than the remaining finance (similar to negative equity situations). Also, a car could lose value faster than you anticipate, although this is a risk with any ownership-based option.

- Less Flexibility to Upgrade: Unlike PCP, there’s no built-in option to change cars partway without settling the loan. Of course, you can always trade in the car for a new one by clearing the remaining HP (often the dealer will handle this by using the trade-in value to pay off your balance), but there’s no pre-set mechanism. In other words, no built-in upgrade cycle – HP is more of a one-car commitment.

Best for: HP is best for buyers who plan to keep the car for a long time or want full ownership at the end of the finance term. If you’re buying a car (new or used) that you intend to hold onto, and you don’t mind higher monthly payments in exchange for avoiding a balloon payment later, HP is a strong choice. It’s also suitable for those who drive a lot (since there’s no mileage penalty) or those buying used cars that may not qualify for PCP deals. Businesses or individuals who want an asset at the end of payments (for example, a company that wants to own its vehicles outright) may also prefer HP. Essentially, choose HP if you want the car to be yours and value simplicity and certainty over the lowest possible monthly cost.

Leasing (Personal & Business)

Leasing a car (also known as Personal Contract Hire for personal leases) is essentially a long-term rental. It’s a bit like PCP without the option to buy the car at the end. Leasing has become a popular option for businesses managing fleets, and it’s available to personal consumers in Ireland as well (though personal leasing is less common than PCP/HP).

How it works: When you lease a car, you pay an initial amount (often called a deposit or initial rental, typically the equivalent of a few months’ payments) and then a fixed monthly fee to use the car for a set period (e.g. 2, 3 or 4 years). Unlike PCP or HP, there is no ownership at the end – when the lease is up, you simply return the car to the leasing company. The monthly lease payments cover the car’s depreciation during your term, plus the leasing company’s costs and profit. Since you’re only paying for the portion of the car’s life that you use, the cost tends to be lower than financing the full vehicle price.

Leases come with conditions very similar to PCP: you must adhere to a mileage limit and maintain the car’s condition, as the car must be returned in good shape. Excess mileage charges apply if you go over, and charges for damage beyond normal wear will be billed at the end. Many lease agreements include or offer maintenance packages – for example, you can have all routine servicing, road tax, and sometimes even insurance or tyres included for a fixed cost. This can make leasing a “hassle-free” option, where you just put fuel in the car and everything else is taken care of.

Because a lease is a form of hire, businesses can often treat lease payments as an expense. VAT-registered companies may reclaim some of the VAT on lease payments (if it’s a qualifying business-use vehicle), and at the end of the lease they don’t have to worry about selling the car. This is why many companies lease company cars rather than buy them.

Pros: Leasing offers several appealing benefits:

- Lower Monthly Cost: Monthly lease payments are usually lower than a loan or HP payment on the same car, since you’re not paying towards ownership. You’re essentially covering the depreciation. This can put expensive cars within reach monthly-payment-wise, though keep in mind you never own the asset.

- No Depreciation or Resale Worries: With a lease, you don’t have to concern yourself with the car’s resale value. When the term is over, you hand back the keys and walk away (or lease another new car). The risk of the car’s value at the end is on the leasing company, not you. This can be stress-relieving – no need to haggle trade-in prices or sell a used car.

- Regular Upgrades to New Cars: Leasing makes it easy to drive a new car every few years. If you enjoy having the latest model with updated technology and safety features, leasing lets you upgrade in a structured way. When one lease ends, you can start another on a brand new vehicle.

- Maintenance and Tax Included: Many lease agreements bundle maintenance, repairs, road tax, and sometimes even insurance into the monthly cost (or offer them as add-ons). This means fewer surprise expenses and a simple life – for example, a business might opt for a fully maintained lease so that all servicing and tyre replacements are covered. For the lessee, it’s very convenient and hassle-free.

- Tax Advantages for Businesses: For companies, leasing can have financial benefits. Lease payments can often be written off as a business expense, and as mentioned, VAT on those payments may be partly recoverable if the vehicle is for business use. It also keeps the car off the company’s balance sheet (since it’s not an owned asset), which can be advantageous in some accounting situations. In short, it’s great for company cars and fleets.

Cons: There are some important downsides to leasing to weigh up:

- No Ownership or Equity: Perhaps the biggest con is that you never own the car in a standard lease. You’re effectively renting, so after spending maybe 3 years making payments, you have to give the car back and have no asset to show for those payments. Over the long run, always leasing can be more costly than buying and holding a car, because you’re perpetually paying for a new car’s depreciation.

- Mileage & Condition Restrictions: Just like PCP, leases come with mileage limits and expectations of condition. If you underestimate your driving and exceed the limit, the per-kilometer charges can add up quickly. Likewise, any dings or damage beyond normal wear can result in hefty end-of-lease fees. This means leasing is not very flexible if your usage changes (say you take a new job farther away – you can’t just freely drive extra miles without cost).

- Contract Commitment: A lease is a binding contract for the full term. If you need to terminate the lease early, it can be very expensive – often requiring you to pay the remainder of the lease payments or significant penalties. You generally can’t exit easily just because you no longer need or can afford the car. There’s also usually no option to extend short-term; any changes to the contract might come with fees.

- Less Flexibility: Leasing doesn’t allow you to alter the vehicle (no aftermarket mods, since you have to return it). You also must coordinate returns and possibly inspections at lease-end. If you really like the car, you often can make an offer to purchase it at the end, but that price isn’t predetermined like a PCP’s GMFV – it would be a negotiation with the leasing company and might not be a good deal.

- Credit and Cost Considerations: Leases still require good credit, and while monthly costs are lower, you might be spending more in perpetuity. For individuals, leasing can sometimes end up more expensive than a well-chosen HP or loan deal if you keep trading cars frequently. You have to be comfortable with endless monthly payments as the trade-off for always having a new car.

Best for: Leasing is typically best for businesses and professionals who want an easy, predictable way to have new cars for work use without the hassles of ownership. Companies that provide employees with company cars often lease them, because it’s cost-effective and includes maintenance. For individuals, a lease might appeal if you truly never want to own a car and prefer to swap vehicles often, and you drive a predictable amount. It’s also a good option if you can expense the lease (e.g. if you’re a business owner or your job provides a car allowance), or if you value the convenience of an all-inclusive package. However, if you eventually want to have an asset (the car itself) or you drive lots of kilometers, other financing routes may be better. Think of leasing as paying for use and convenience rather than ownership.

Bank or Credit Union Car Loans

Taking out a car loan from a bank or credit union is a straightforward way to finance a vehicle. This is essentially an unsecured personal loan (or sometimes secured against the car or other collateral) that you use to buy the car outright. Unlike PCP or HP, the loan isn’t tied to the car in the same structured way – you receive the money (or the dealer is paid) and you purchase the car, becoming the owner immediately, then you repay the loan to the lender over time.

How it works: You apply for a loan for the amount you need to purchase the car (minus any deposit you’re paying from savings or a trade-in). Many banks in Ireland offer specific “car loans,” but effectively they function like any personal loan. Loan terms can range from 1 to 5 years, sometimes up to 7 years for larger amounts. The bank or credit union will charge interest on the loan; rates can be fixed or variable. As of 2025, typical interest rates for car loans might range roughly from around 6% to 9% APR, depending on the lender and your credit profile (for example, credit unions often advertise rates around 7–8% APR, though some have special lower “green car” rates). You can often borrow 100% of the car’s price – no down payment required – but a larger loan will mean more interest in total.

Once approved, you use the loan funds to buy the car from the seller (dealer or private). You then own the car from day one. Your obligation is simply to repay the loan in the agreed monthly installments. There’s no balloon or anything at the end (it’s fully amortizing payments, like most personal loans). Since the car is yours, you’re free to sell it or trade it at any time; you’d just need to continue repaying the loan (or pay it off from the sale proceeds). Notably, because the car isn’t tied up in a finance agreement like HP/PCP, you could sell the car mid-loan and not have to get the lender’s permission – though you’d still owe whatever balance is on the loan.

Pros: Car loans via bank or credit union have several key advantages:

- Immediate Ownership: Perhaps the biggest benefit – you own the vehicle outright as soon as you purchase it. The car is in your name from the start, so you’re free to use it with no contractual restrictions (just keep it insured and roadworthy!). This also means you can modify or sell the car whenever you want, without lender approval.

- No Usage Restrictions: Because it’s your car, there are no mileage limits or condition clauses to worry about. Drive it as little or as much as you like. Unlike PCP/lease, nobody will inspect it at the end of a term – there is no “end of term” until you choose to change cars. This freedom is ideal for those who have unpredictable driving needs or just don’t want to be constrained.

- Flexible Loan Terms and No Deposit: You can often choose a repayment period that suits you (within the lender’s offered range), and you usually don’t need a deposit at all – you can finance the full price of the car. This is helpful if you haven’t saved up or don’t have a trade-in. While a deposit or part-payment will reduce your loan and interest, it’s not mandatory as it is with many dealer finance deals.

- Shopping Power and Independence: Having loan approval (or cash in hand) allows you to shop around like a cash buyer. You’re not tied to one dealership’s finance offer, so you can potentially negotiate a better vehicle price with the seller since you’re effectively paying cash. Also, you can buy from any source – dealer or private seller – which PCP/HP (usually dealer-only) might restrict. This flexibility can lead to better deals on the car itself.

- Potentially Lower Interest Rates: It’s worth comparing, but often independent loans can have competitive or lower interest rates than dealer-arranged finance. For example, some banks offer preferential rates for higher loan amounts or for green (electric/hybrid) cars. Credit unions also may offer reasonable rates and are willing to work with members on terms. If you have a good credit score, you might snag a loan rate that beats the typical PCP/HP APR. Plus, bank loans usually have no hidden fees – just interest – whereas dealer finance might have admin fees.

- No Final Surprises: There’s no big payment lurking at the end. If you’ve paid on time, you’re done – and you still have the car. You can also usually clear the loan early if you want, often without penalties (many credit unions and banks allow extra payments or early payoff with minimal or no fees, but always check). This means if you come into some money, you can get debt-free faster.

Cons: There are some considerations and downsides to taking a personal/credit union loan:

- Credit Requirements: To get a loan with a decent interest rate, you generally need a good credit history. Banks will check your credit score and ability to repay. If you have a poor credit record, you might be declined or offered a very high rate. (In contrast, with dealer finance like HP, the car is collateral, so they might approve you more easily or with a smaller credit check.) Some people with fair/bad credit might find it easier to get approved for PCP/HP through a dealer than a bank loan. Credit unions can be a bit more flexible, considering your overall situation rather than just a score, but they too must lend responsibly.

- Higher Monthly Payments: With a traditional loan, there’s no balloon or portion deferred – you’re financing the entire cost, similar to HP. If you also choose a shorter term (many people opt for around 3-5 years), your monthly payments could be higher than a PCP’s for the same car. In other words, the affordability advantage of PCP’s low monthly cost isn’t present with a normal loan. You need to budget for the full cost in a shorter time frame, which can limit how expensive a car you can comfortably buy.

- Interest Rates Can Vary: The interest rate you get on a personal loan depends on market rates and your credit. Sometimes, promotional finance (especially on new cars) can actually beat a bank loan rate. For instance, a dealer might offer 0% or 3.9% APR on a new model, while a bank loan might be 7% – in that case, the dealer deal is cheaper interest-wise. So, you do need to shop around for rates and not assume a bank loan is always lowest. Additionally, if you’re buying an older used car, some lenders charge higher interest or have lower term limits for older vehicles.

- You Bear Depreciation & Resale Hassles: Since you own the car, you take on the depreciation risk entirely. If the car’s value plummets, that’s on you – there’s no handing it back to escape negative equity as in PCP. When you want to change cars, you’ll have to sell or trade it in yourself. That process can be time-consuming, and the sale price might not cover any remaining loan if the car’s value dropped fast. Basically, all the usual responsibilities of car ownership (selling, maintenance, etc.) are on your shoulders with a loan – there’s no built-in convenience factor.

- No Dealer Perks: Dealer finance deals sometimes come with perks (like service plans, extended warranties, or deposit contributions from the manufacturer). If you finance independently, you might miss out on such offers. You’ll also have to arrange the financing paperwork yourself by dealing with the bank/credit union, rather than the dealer doing it for you. It’s a bit more legwork to secure the loan and coordinate payment to the seller.

- Discipline Required: With no contract limiting you (as in PCP), you need personal discipline not to over-borrow. It’s wise to stick to a budget you can afford, even if a bank offers a larger loan. Also, since you own the car, if you default on the loan, the lender can still pursue you (they could take you to court, affect your credit score severely, etc.), though they won’t repossess the car directly (unless it’s a secured loan). Missing payments on any finance is bad news, but a personal loan relies solely on your promise to pay, so maintain good financial habits to avoid trouble.

Best for: A bank or credit union loan is best for those who want full freedom and ownership from the start, and who have (or can obtain) a solid credit deal. It’s great for buyers who have found a good deal on a car (perhaps a used car from a private seller or a dealer with no finance incentives) and want to simply finance it in the most straightforward way. It’s also ideal for people who drive a lot (no mileage fees) or plan to keep the car long beyond the loan term, extracting maximum value from ownership. If you value simplicity, no strings attached to the car, and possibly lower total interest paid (depending on rates you qualify for), a personal car loan is a strong choice. Just make sure to compare offers – for example, check with your bank and local credit union – and look at the APR and terms to ensure it’s favorable. As the Irish League of Credit Unions notes, traditional car loans often have no hidden fees, no mileage limits, and can offer competitive interest rates with greater flexibility than PCP.

Dealer Finance vs. Independent Lenders

When financing a car, you generally have a choice between dealer-arranged finance (through the car dealer’s affiliated lenders or manufacturer finance programs) and independent financing (like getting a bank or credit union loan as discussed above). Each route has its own advantages, and it’s wise to compare both.

Dealer Finance usually means PCP or HP offered at the dealership. The dealer works with a finance company (often the car manufacturer’s finance arm or a partner bank) to provide on-the-spot financing. This is convenient – you can choose your car and sort the finance in one place, often on the same day. Dealers may also sweeten deals with incentives: for instance, low or zero percent APR offers, cashback, or deposit contributions on certain models. These promotions can make dealer finance very attractive on a new car (e.g. a 2% APR PCP is hard for any bank loan to beat). Additionally, dealer finance might be more accessible if you have only fair credit, since the loan is secured by the car and dealers are motivated to close the sale.

On the flip side, dealers sometimes mark up the interest rate or receive a commission on finance deals. The rate they offer might not be the best you qualify for. It’s not uncommon for a dealer to offer, say, 8% APR on a used car HP, while your bank might approve a 6% loan for the same amount. Also, dealer finance contracts can include administration fees (startup fees, completion fees) that add to your cost. Always ask for the total cost of credit and compare the APR to other options. Dealer finance can also be less flexible – you’re limited to the cars that dealer sells and their finance terms.

Independent Lenders (banks, credit unions, online loan providers) give you the freedom to shop around for the best interest rates and terms on a car loan. As mentioned, personal loans can sometimes have lower interest rates than dealer PCP/HP offers, especially for used cars or if you have excellent credit. Going to your own lender also means you can get pre-approval, so you know your budget before you ever set foot in a showroom. Another benefit is transparency: a bank will quote you a clear monthly payment and total cost, without the sales pressure of a dealership environment.

One strategy is to get quotes from both – see what the dealer can offer and also get a quote from an independent lender. For example, if a dealer’s finance is convenient but carries a higher interest, you might negotiate the car’s price down or ask if they can match a lower rate you found elsewhere. Don’t forget to check for any hidden fees: a dealer PCP might have an documentation fee or an optional purchase fee at the end, whereas a credit union loan might have none. Also consider flexibility: with your own financing, you effectively become a cash buyer at the dealership, which can give you leverage to negotiate the vehicle price. Dealer finance tends to focus you on “monthly payment” negotiation, which can sometimes obscure the overall price you’re paying for the car.

When to choose which: If the dealer is running a special finance deal (e.g. 0% APR or a sizable deposit contribution) and you’re comfortable with the terms, dealer finance can be a no-brainer for cost savings. Likewise, if you prefer PCP and the dealer is the only avenue for that, you may go with dealer finance. On the other hand, if you find the dealer’s interest rate high or the terms restrictive, shop around independently – you might find a better loan and simply use it to pay for the car. This is often the case for used car purchases, where dealer finance rates can be higher. Additionally, if you’re buying from a private seller or a smaller garage that doesn’t offer finance, an independent loan is the way to go.

In all cases, compare the APR (Annual Percentage Rate) and the total you will pay over the duration. Also, ensure you’re comparing like-for-like (e.g. a 3-year loan vs a 3-year PCP with a balloon – factor in what happens at balloon time). Remember that what matters is not just the monthly payment, but the total cost and how well the plan suits your needs. As a rule of thumb, don’t simply accept the first finance offer from a dealer without comparing. A bit of extra research can save you a lot of money. Ultimately, the best financing option is the one that offers the most favorable terms for your situation – be it through a dealer or on your own.

Comparing Financing Options – What’s Best for You?

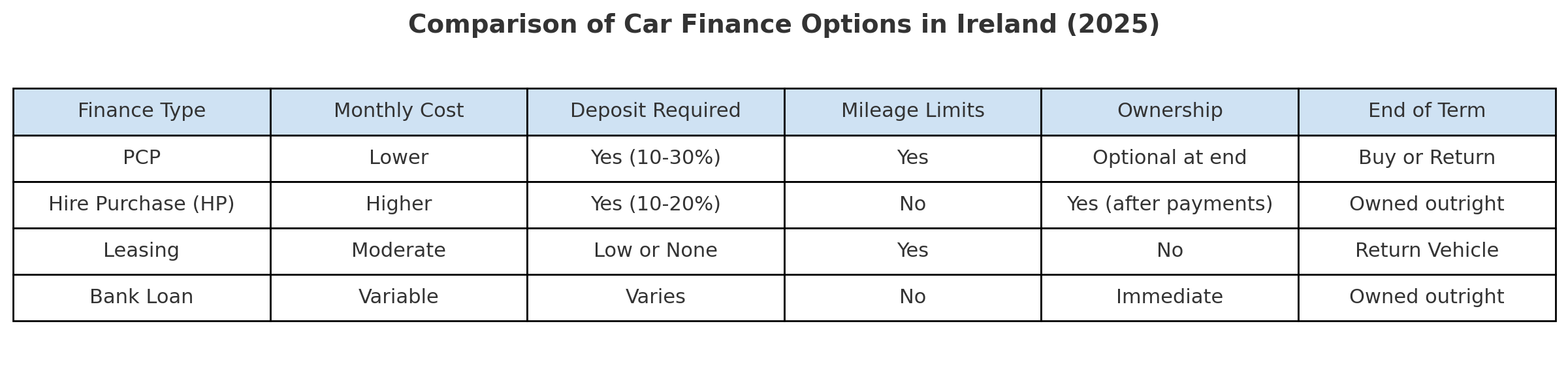

With multiple car finance routes available, it can be challenging to decide which is best for you. The “best” option will depend on your priorities – whether it’s lowest monthly cost, eventual ownership, flexibility, or overall cost-efficiency. Below is a side-by-side comparison of PCP, HP, Leasing, and a Car Loan on some key factors:

| Financing Option | Typical Monthly Cost | Ownership | Usage Restrictions | Flexibility |

|---|---|---|---|---|

| PCP (Personal Contract Purchase) | Lowest (payments only cover part of car’s value, making it very budget-friendly monthly). | Optional: You only own the car if you pay the final balloon (otherwise, you return or trade it). | Yes – mileage limits and must keep car in good condition. Early termination requires paying off half the total owed. | End-of-term options (buy, return, swap) provide flexibility at contract end, but during the term you’re locked in with little flexibility to change the plan. |

| HP (Hire Purchase) | Higher (you’re financing the full car price, so payments are significantly more than PCP for the same car). | Yes (after final payment): You own the car once all installments are paid. Until then, it’s owned by the finance company. | No usage restrictions – no mileage caps, no return condition worries. You should maintain the car as an owner would. | Moderate flexibility: You can’t swap cars mid-term without settling the finance. However, you can keep the car as long as you want after payoff, and you have the right to end the agreement early once 50% is paid (with conditions). |

| Leasing (Personal or Business) | Low (comparable to or even lower than PCP, since you only pay depreciation, not building equity). | No: You will not own the car (you must return it at lease end, unless you separately arrange to purchase at market value). | Yes – mileage limits and must return in agreed condition. Often required to service at specified garages. | Limited: You are committed for the lease term; no option to buy in contract. You can usually upgrade only by taking out a new lease once the current one ends. Early termination is costly. |

| Bank/Credit Union Loan (independent finance) | Varies – can be medium to high. You pay off the full amount borrowed. Monthly cost depends on loan size/term (no deferral of principal as in PCP). | Yes (immediate): You own the car from day one. The car is yours outright, even as you repay the loan. | None – it’s your car. No mileage or usage restrictions at all. | High flexibility: You can sell or trade the car anytime (proceeds ideally used to clear loan). You can refinance or pay off the loan early (often without penalties). You’re not tied to a dealer or contract beyond making loan payments. |

Each financing type shines in different scenarios. Here are a few common scenarios and the best options to consider for each:

- “I want the lowest possible monthly payment on a new car.” If keeping the monthly cost ultra-low is your priority, PCP is often the winner. PCP’s structure of deferring a chunk of the price means your installments will be much smaller than an equivalent HP or loan. This is why first-time buyers on tight budgets often choose PCP – it makes that brand-new car with all the tech seem affordable. Just remember you’ll either need to give the car back or refinance the final amount after those low payments. Leasing is another route to low monthly payments (with no intent to own), but between PCP and a lease for a personal user, PCP gives you the option to buy the car, which some prefer as a form of flexibility.

- “I plan to keep my car for many years and drive a lot.” In this case, Hire Purchase or a Car Loan is likely the better fit. With either HP or a loan, you’re working toward full ownership, and there are no mileage restrictions to worry about. You’ll pay more per month than PCP, but after it’s paid off, the car is yours with no further payments. This suits a family car that you want to maintain and use for, say, 5-10 years. HP might be easier if you’re buying from a dealer, whereas a personal loan gives you added flexibility to buy from anywhere. If you clock high kilometers annually (e.g. long commute or frequent travel), avoid PCP/lease – the extra charges for exceeding mileage could be costly, or you’ll have to opt for an expensive high-mile PCP plan. HP/loan has no such penalty – drive to your heart’s content.

- “I love getting a new car every 2-3 years.” PCP or Leasing will be most appealing here. Both options cater to those who want to upgrade regularly without the fuss of selling an old car. PCP gives you the choice at 3 years to swap into a new car (often using any equity as deposit), and this is how many people continuously drive new cars under warranty. Leasing similarly lets you return and immediately start a new lease on a new vehicle. The difference: PCP might let you keep the car if you decide you really like it, whereas a lease is a pure return. If you want the option to own, lean PCP; if you’re certain you never want to own the car, a personal lease could be slightly simpler (and sometimes a bit cheaper, especially when maintenance is included). Many company executives or professionals who get a car allowance might lease a car for 3 years, then swap – always having a new model. Keep in mind, regularly upgrading means you are continuously under finance payments – essentially a permanent car payment as a lifestyle choice.

- “I’m buying a used car (few years old).” Hire Purchase or a Bank Loan is usually the go-to for used purchases. PCP on used cars is less common (dealers may offer PCP on approved used cars up to a certain age, but the terms might not be as favorable as for new). HP is very common for used car sales through dealerships, and you’ll own the car at the end. For example, if you’re buying a 4-year-old car from a dealer, they might offer a 3-year HP. Alternatively, you could get a credit union loan and pay cash for the car. Compare the interest rates – sometimes dealer HP rates on used cars can be a bit high, so a credit union loan at, say, 7% APR might beat it. If it’s a private sale (buying from another person), a personal loan is essentially your only finance option since dealer finance won’t be in play. Also, for older used cars, the cost of finance vs the value is a consideration – you wouldn’t typically do PCP on a 8-year-old car, for instance. HP/loan is straightforward in such cases.

- “I’m a business owner looking for a company car (or a fleet of vehicles).” Leasing is often the top choice for businesses. It offers tax advantages and administrative ease – you can roll maintenance, insurance, and even fuel cards into leasing deals, making it simple to manage multiple vehicles. At the end of the lease, you upgrade the fleet to keep it modern and reliable. This saves your business from having depreciating assets on the books or having to sell old company cars. Also, lease payments are usually fully deductible business expenses. Some businesses do use HP (especially if they eventually want the assets or if the resale value is important to them) – for example, a small company might take an HP on a van and keep it long term. But many lean towards operational leasing for cars. If you’re a self-employed individual, you might also consider leasing if you can expense the cost. However, if you want to avoid a long-term expense and perhaps drive the car for a decade, an HP or loan to buy a vehicle (and then claim depreciation and expenses on your taxes) could be more economical.

- “I have shaky credit or I’m worried about approval.” A Hire Purchase agreement might be easier to get approved than a bank loan, because the car is security for the lender (so it’s lower risk for them). Dealers often have multiple finance partners and can try to get an approval for you. However, be cautious: sometimes this means a higher interest rate. A credit union might be a good option too – they often work with people with less-than-perfect credit, looking at your overall situation (sometimes at slightly higher interest but still reasonable). PCP also requires credit approval and, due to its complexity, lenders will check that you can afford that final payment or have a plan. If credit is a concern, start by pulling your credit report and maybe consult with a financial advisor on improving your standing. It might be worth waiting a bit to build your credit before taking on a car finance, so you qualify for better rates and terms.

These scenarios illustrate that the “best” car finance in Ireland really depends on the person or business in question. There is no one-size-fits-all answer – PCP vs HP vs Lease vs Loan each serves different needs. Always consider the total cost vs. benefit: a low monthly payment is nice, but factor in final payments or the fact you’re left with no asset. Conversely, a higher payment plan that leaves you with a car at the end can be worth it if you plan to keep it long-term.

Tips to Get the Best Car Finance Deal

No matter which finance route you lean toward, there are general strategies to ensure you’re getting the best deal and not paying more than necessary. Car finance is a big commitment, so a bit of preparation and savvy shopping can save you a lot. Here are some top tips:

- Know Your Budget and Stick to It: Before you even talk to lenders or dealers, crunch the numbers. Figure out how much you can comfortably afford per month and as an overall purchase price. Remember to account for insurance, fuel, and maintenance in your car budget, not just the finance payment. It’s easy to be tempted into stretching for a higher spec car, but be realistic. Set a firm price range for the car and don’t forget the additional costs like motor tax. A good practice is to get pre-approval from a bank or at least use online calculators to see what loan amount corresponds to your target monthly payment. This prevents you from being upsold in the heat of the moment.

- Improve Your Credit Score (if needed): Your credit score plays a big role in the interest rate you’ll be offered. Check your credit report for any issues or mistakes well before applying. If you have outstanding credit card debt or small loans, paying them down can help boost your score (and also frees up money for a car payment). Make sure you’re up-to-date on all bills for at least six months leading to your finance application – a history of on-time payments will make lenders more confident. If you have no credit history (common for young buyers), consider building some credit by maybe using a credit card responsibly or a small credit-builder loan. Bottom line: a better credit score can qualify you for significantly lower interest rates, which reduces your total cost. It can literally save you hundreds of euro over the life of a car loan.

- Save for a Deposit (if you can): While some options don’t require it, having a decent deposit (even 10% of the car’s price) can be very beneficial. It will reduce the amount you need to finance, which in turn cuts your monthly payment or shortens the loan term. It may also qualify you for a better rate or deal. For example, PCPs and HPs often have minimum deposit requirements, but if you put down more than the minimum, you’ll borrow less and pay less interest overall. Some banks give better rates for lower loan-to-value ratios as well. Tip: If you’re trading in an old car, that can serve as your deposit. And if you know you want to buy a car in a year or two, start setting aside savings now for a down payment.

- Shop Around for the Best Interest Rate: Don’t assume the first finance quote you get is the best. Interest rates (APR) can vary widely between lenders for the same person. Request quotes from your bank, a credit union, and through the car dealer’s finance office, then compare not just the monthly payment but the APR and total amount payable. Even a 1-2% difference in APR can make a big difference over several years. Also look at different types of finance – perhaps a personal loan at 6.5% APR vs a PCP at 4.9% APR vs an HP at 8% APR. Compare like-for-like durations. Use online comparison tools or loan calculators to evaluate deals. By researching and comparing providers, you can find the most competitive rate and terms for your situation.

- Negotiate – Both Car Price and Finance Terms: Everything is negotiable! When at a dealership, negotiate the car’s price first, independent of the financing. Dealers might try to focus you on “what monthly payment works for you?” – but that can mask the actual price you’re paying. Instead, settle on a good purchase price for the vehicle (or as good as you can get) before finalizing finance. Then, if you’re using dealer finance, see if they can do better on the rate or throw in extras. Let them know you’re comparing with your bank – if they really want the sale, they might cut you a deal (like waiving an admin fee or reducing the APR a bit). If you already have a loan offer from elsewhere, you can use it as leverage: “I have been approved at X% APR, if you can match or beat that, I’m ready to sign.” Some dealers might not budge on interest if it’s a fixed program, but it doesn’t hurt to ask. At the very least, you could negotiate free additions (floor mats, a tank of fuel, servicing plan, extended warranty, etc.) to sweeten the overall deal.

- Watch Out for Hidden Fees and Extras: Always read the finance contract or loan agreement carefully. Look for any fees – common ones in car finance include documentation fees, acceptance fees, or an option-to-purchase fee at the end of an HP (sometimes €50-€100). Ensure these are clearly disclosed. Also, check if there are penalties for early repayment. Many loans in Ireland allow early repayment with at most a modest fee, but some HP/PCP agreements might charge a few months’ interest as a penalty if you clear the finance early. Be aware of any late payment fees too, though hopefully you won’t miss any payments. Additionally, consider insurance products the dealer/lender might push, like GAP insurance or payment protection insurance – these can be useful, but they come at a cost. Only add them if you truly need them and the price is reasonable. In short, understand the full cost of the finance beyond just the interest rate.

- Consider Total Cost, Not Just Monthly: A trap buyers sometimes fall into is focusing solely on the monthly payment. While it needs to be affordable, stretching a loan out longer can make the payment smaller but you pay more interest in total. For example, a 3-year loan vs a 5-year loan – the 5-year will have lower monthly payments, but two extra years of interest. Similarly, a PCP might look super affordable per month, but if you end up rolling into another PCP and another, you might be perpetually in debt (potentially even rolling negative equity forward). It’s important to calculate the total expenditure. Ask the dealer or lender for the total amount payable on any finance agreement. This helps you compare the true cost. Sometimes, a slightly higher monthly on a shorter term will save you money overall. Or if you intend to keep the car, consider that after an HP or loan is done, you have an asset and no more payments – whereas with PCP/lease you might always have a payment. Weigh these factors with your personal priorities.

- Plan for the Future: Think about your 3-5 year plan. Are you likely to start a family (needing a bigger car) or change jobs (maybe get a company car or need a more efficient car)? Such life events can influence what finance makes sense. If you anticipate needing a different car soon, a shorter-term PCP or lease might be better than a 5-year HP. If you expect stable times and long-term use, a loan or HP where you’ll own the car is great. Also, if you opt for PCP, have a strategy for the balloon payment: e.g., set aside a small amount each month in a savings account so you build up a fund towards that final payment, or plan to sell/trade the car. Don’t just hope the money will magically be there in three years. Planning ahead will prevent panic when the finance term ends.

- Use Finance Calculators and Get Advice: Leverage the many online car finance calculators to play with scenarios. See what happens to payments if you change the term or add a deposit. The Competition and Consumer Protection Commission (CCPC) has useful calculators and consumer advice for car finance. If you’re unsure, consider getting advice from a financial advisor or even consulting forums (like Boards.ie or Reddit’s Irish personal finance community) for opinions – just be wary of sales pitches disguised as advice. The more knowledge you have, the more confident you’ll be in securing a good deal.

- Avoid Impulse Decisions: Finally, don’t rush into a finance agreement on the spot if you’re not 100% sure. It’s okay to tell a dealer “I need to review this and will come back.” Car finance agreements have a cooling-off period (for example, under EU consumer credit rules you often have 14 days to withdraw from a credit agreement). But it’s better to decide correctly upfront than to cancel later. Take the contract home, read it without pressure, and ensure you’re happy with every detail. If something is unclear, ask questions. A reputable lender or dealer should be able to explain all terms in plain language. Remember, you’re the customer – you have the right to understand what you’re signing up for.

Following these tips will put you in a strong position to secure the best car finance deal in Ireland for your situation. With a good deal in hand, you’ll not only save money but also have peace of mind as you drive away in your new (or used) car.

Conclusion

Financing a car is a significant commitment, and it pays to choose the option that best aligns with your needs, budget, and future plans. We’ve covered the main avenues – PCP, HP, Leasing, and Loans – each with distinct pros and cons. In summary, Personal Contract Purchase (PCP) offers low monthly outlay and end-of-term flexibility, ideal for those who like to change cars frequently, but it comes with mileage limits and a hefty final hurdle if you want to keep the car. Hire Purchase (HP) provides a clear path to ownership with no usage restrictions – perfect for long-term owners – though you’ll face higher monthly costs and less wiggle room until it’s paid off. Leasing lets you enjoy a new car with minimal hassle (often including maintenance) which businesses and some private individuals love, but you’ll never own the car and must abide by the contract strictly. A bank or credit union loan gives you maximum freedom – you own the car and can do as you please – yet you need to be creditworthy and comfortable managing the entire financing yourself.

Ultimately, the “best” option comes down to your personal circumstances. Are you after the lowest monthly payment? Is ownership important to you? How many kilometers will you drive? By answering these questions, you can narrow down the choices. Always compare the total costs and read the fine print. Remember, what works for one person (or business) might not be ideal for another – a young professional might love PCP’s low payments, while a rural family might prioritize owning their vehicle outright via HP or a loan.

In any case, knowledge is power. Armed with the information from this guide, you should feel confident in evaluating any car finance offer put in front of you. Take your time, do the math, and make the choice that puts you in the driver’s seat not just in your car, but in your finances as well.

Now that you’re equipped with insight on car financing options in Ireland, you can focus on finding that perfect car. Whether it’s a new model or a reliable used car, make sure it fits your budget and life. When you’re ready to explore what’s available, check out the listings on CarSpot – you’ll find a wide range of vehicles to suit every need. With your financing plan in mind, you can shop with confidence, knowing exactly how that dream car can become a reality. Happy car hunting and safe driving!